Reits Can Invest in All of the Following Except

REITs are similar to closed end investment companies B. B they must invest at least 75 of their assets in real estate related activities.

They invest primarily in real estate and mortgages.

. Through REITs people can invest in real estate portfolios the same way they might invest. Receive at least 75 of gross income from. Normally private REIT shares.

The real estate can be depreciated even if its market value is increasing B. These factors include mortgage rates prepayments of a loan before the due date and credit events like foreclosure or bankruptcy. You can purchase shares of a non-traded REIT through a broker that participates in the non-traded REITs offering.

B ownership of real property without management responsibilities. A real estate investment trust REIT that aims to sell its real estate holdings within a specified time frame so. Audi A4 2018 Price Malaysia.

Finite-Life REIT - FREIT. Most REITs focus on a particular property type but some hold multiples types of properties in their portfolios. You can quickly adjust your asset allocation to REITs by trading units.

You can also purchase shares in a REIT mutual fund or REIT exchange-traded fund. D pass-through tax treatment of income. Excess funds can be invested in securities however under the tax code at least 75 of the REITs assets must be invested in real estate or mortgages.

The property being purchased can be financed with a mortgage reducing the cash downpayment C. REITs also play a growing role in defined benefit and defined contribution investment plans. Reits Can Invest in All of the Following Except.

They invest primarily in real estate and mortgages under the tax code at least 75 of the REITs assets must be invested in real estate or mortgages. Rumah Sewa Di Petaling Jaya. Can You Use Refrigerated Biscuits After Expiration.

Owasp Top 10 Attacks. Harrier Second Hand Price. They invest primarily in real estate and mortgages under the tax code at least 75 of the REITs assets must be.

This makes sense because REITs cannot pass losses to their shareholders. Governments and can also be invested in the shares of other REITs though this rarely happens. These REITs are exempt from SEC registration and are available via private placements andor crowdfunding portals.

When the real estate is sold all profits are taxed at preferential short term rates. Usually 1000 to 2500. Any excess funds can be invested in securities such as US.

The second type of real estate investment trust is an equity REIT. Available through fix-and-flip projects. This is a big draw for investor interest in REITs.

Sizeable capital investment typically 20 to 40 of purchase price. A REITs are negotiable securities B R EITs issue shares of beneficial interest representing an undivided interest in a pool of real estate investments CO REITs are similar to open-end investment companies D REITs are registered under the Securities Act of 1933 All of the following statements about investment. Interest on loans is fully deductible D.

Individuals can invest in REITs in a variety of different ways including purchasing shares of publicly traded REIT stocks mutual funds and exchange-traded funds. By investing in a REIT you are provided all of the following EXCEPT. A pass-through tax treatment of operating losses.

C they must distribute at least 90 of their net investment income to qualify under Subchapter M. An equity REIT owns and. C diversification of real estate investment capital.

D shares are publicly traded. Only from appreciation of REIT units. Although these REITs are SEC-registered they are not listed on national stock exchanges.

A Muscle Fascicle Is Surrounded by. Check Owner Car Plate Number. Over-the-counter trading is performed through brokerdealers and possibly through online portals.

A real estate investment trust also known as a REIT is a company that pools money from investors to buy operate or finance revenue-generating real estate. Ais Krim Viral Di Penang. This makes sense because REITs cannot pass losses to their shareholders.

REITs allow everyday people not just banks and hedge funds to earn money from real estate. Since the primary way the mortgage REIT survives is through the interest earned many factors can make a mortgage REIT strong or weak. A they must pass along losses to shareholders.

All of the following are major tax benefits of real estate limited partnerships EXCEPT. REITs are listed and trade on stock exchanges D. A REIT or real estate investment trust is a company that owns operates or finances real estate.

Created with Highcharts 1000. REITs do not invest in limited partnerships which are tax shelter vehicles. REITs invest in the majority of real estate property types including offices apartment buildings warehouses retail centers medical facilities data centers cell towers infrastructure and hotels.

REITs do not invest in direct participation programs limited partnerships which are tax shelter vehicles. Generally REITs limit individual ownership to a 10 stake. The most popular type of REIT equity REIT focuses on purchasing managing and developing properties such as offices residential complexes retail development hospitals hotels and resorts with the main source.

Invest at least 75 of total assets in real estate or cash. As low as one unit. Maksud With Meal Dalam Bahasa Melayu.

REITs can be broadly classified into these 3 categories. Fleur De Lis Logo. REITs must invest at least 75 of their assets in real estate related activities to qualify for conduit tax treatment.

Commissions do not affect our editors opinions or evaluations. In essence REITs operate like mutual funds except that they invest in real estate exclusively. You can invest in a publicly traded REIT which is listed on a major stock exchange by purchasing shares through a broker.

All of the following are true of REITs EXCEPT. The rule is that no more than 50 of a REIT can be owned by five or fewer people. All of the following statements are true about REITs EXCEPT.

Investing in a REIT is an easy. REITs issue redeemable shares C.

How To Invest In Reits Real Estate Investment Trusts

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

Reit Investing What Is A Reit Ally

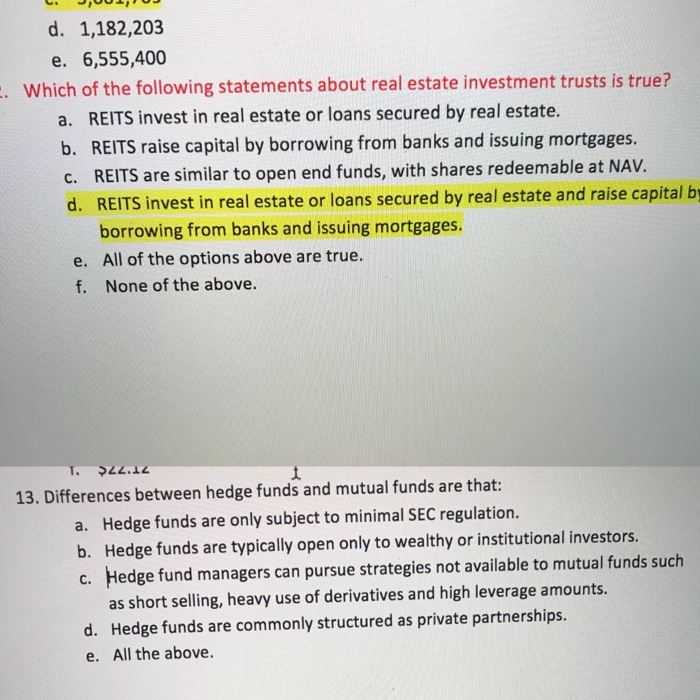

Solved D 1 182 203 E 6 555 400 Which Of The Following Chegg Com

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

No comments for "Reits Can Invest in All of the Following Except"

Post a Comment